Compound interest is the magic that happens when you earn interest on interest or growth on growth.

![]() It can supercharge your investment, especially when you have time on your side. It helps small investors who invest long term do better than investors with more money who start later.

It can supercharge your investment, especially when you have time on your side. It helps small investors who invest long term do better than investors with more money who start later.

This is the reason why, when asked what the most powerful force in the world was, Albert Einstein apparently replied “compound interest”.

He is also widely believed to have described compound interest as “the eighth wonder of the world” and to have said: “He who understands it, earns it, he who doesn’t, pays it.”

It is easy to underestimate how powerful compound interest is in making your money work for you, especially when you start investing with a small amount, and it feels like it will never amount to much.

However, small amounts saved for long periods can also harness the power of compounding as long as your growth, or interest rate, beats inflation and you reinvest that growth or interest rather than having it paid out to you.

It is also easy to forget that when you take out debt, compound interest works against you – which is why Einstein said if you don’t understand it, you pay it.

It is also easy to forget that when you take out debt, compound interest works against you – which is why Einstein said if you don’t understand it, you pay it.

The longer you take to pay off debt, the more interest you will pay. This is because interest is added each month to the amount you owe in addition to the interest added in previous months. Read more: What does credit cost?

The King who didn't get it

To understand compound interest, it helps to remember an often-told tale about a Persian king who loved games and was presented with the game of chess. Happy with the new game, he asked the inventor of the game how he could reward him.

|

DO YOU KNOW THE RULE OF 72? If you want to know how quickly the money you have saved will double, use the rule of 72. Take 72 and divide it by the interest rate you are earning on your money. The answer will show you how quickly your money will double.

|

The man asked for a grain of rice to be placed on the first square of the chess board and for that grain to be doubled on the second square, and on each subsequent square until, the 64th one.

The king, who did not understand the power of exponential growth, readily agreed.

However, when the grains were counted out, they soon mounted up: at the end of the first row, there were only 128 but by the 21st square, the king had to supply more than a million grains.

On the 41st square, the king was liable for a trillion grains and by the time the 64th square was reached, the king was up for 18-trillion grains of rice.

According to the legend, the reward bankrupted the king, forcing him to hand over his kingdom.

Although you are not likely to double your money each month or year, the legend illustrates the power of compounding.

How to earn compound interest on your investments

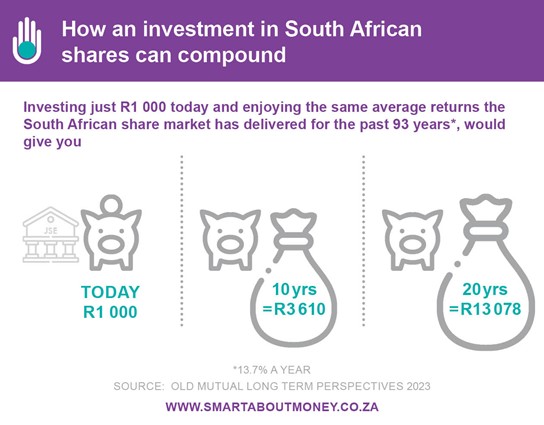

An investment in a bank savings account or money market account or fund will earn interest that can compound if you reinvest the interest. ![]() But you will see a bigger impact of compound interest if you invest in the likes of unit trusts or exchange traded funds that have some exposure to equities or listed property. These investments will earn you earn dividends that will grow with inflation and you will also earn interest on any bonds or cash in your fund. If you reinvest these distributions they will compound.

But you will see a bigger impact of compound interest if you invest in the likes of unit trusts or exchange traded funds that have some exposure to equities or listed property. These investments will earn you earn dividends that will grow with inflation and you will also earn interest on any bonds or cash in your fund. If you reinvest these distributions they will compound.

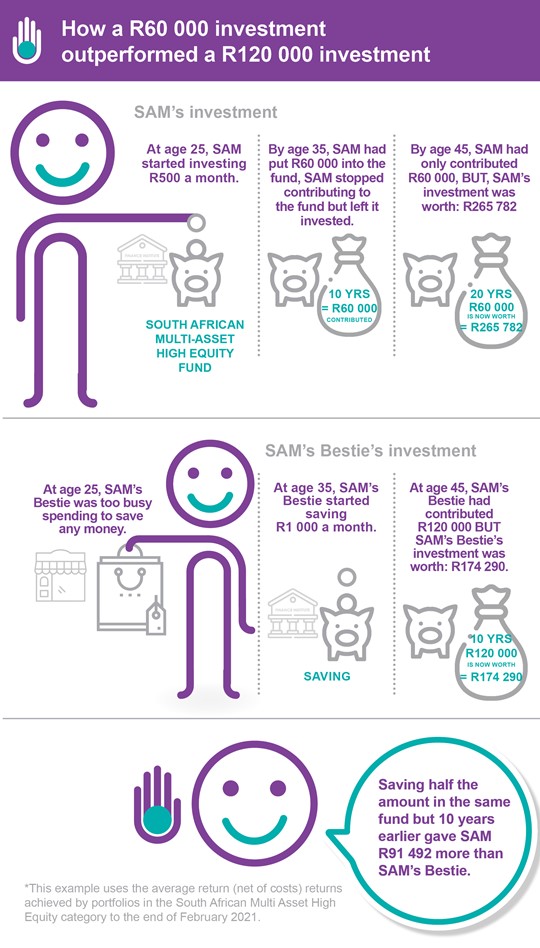

It may be at a more modest level than the game inventor's rice, but over many years compounding can get your investment ahead of that of someone who starts saving more than you but starts later than you.

When you are saving for the long term, as you do when you save for retirement, your savings can initially seem small and you may be tempted to draw them out. But if you do, you will not experience the power of compounding when you are older. Savers who stay invested often only appreciate the power of compounding in the years close to retirement when they really see their money grow rapidly.

The Actuarial Society of South Africa provided some examples that illustrate the power of compounding over time and how it can help smaller investors outperform those with larger amounts, as long as they start early. See the example of SAM and SAM's Bestie and their investments below.