Collective investment schemes are investments in which you pool your money with that of other investors and they are managed by experienced fund managers who select a range of assets such as shares, bonds, property shares, cash instruments or even physical property.

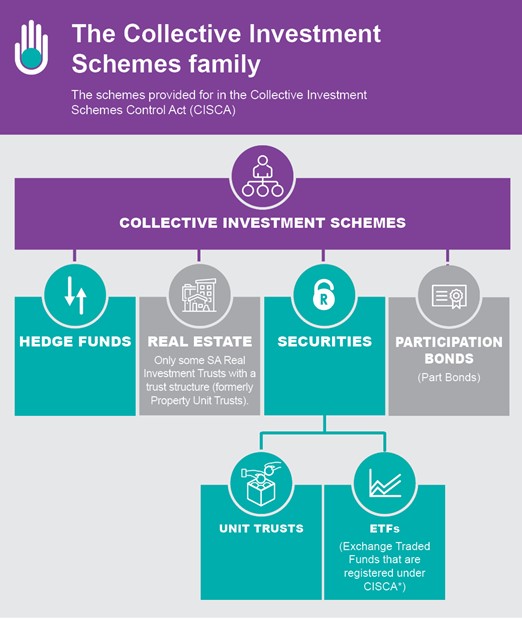

There are four types of collective investment schemes identified in the Collective Investment Schemes Control Act (CISCA), which is the South African law governing collective investment schemes:

![]() These schemes invest in factories, shopping centres and office blocks. They were previously called property unit trusts, but now they are called real estate investment trusts (REITS). Only a few South African REITS have a trust structure and are registered as collective investment schemes.Most South African REITS have a company structure and are not registered as collective investment schemes. All REITS are also listed on the JSE.

These schemes invest in factories, shopping centres and office blocks. They were previously called property unit trusts, but now they are called real estate investment trusts (REITS). Only a few South African REITS have a trust structure and are registered as collective investment schemes.Most South African REITS have a company structure and are not registered as collective investment schemes. All REITS are also listed on the JSE.

![]() These schemes enable investors to invest in mortgages or loans over properties. These investments have minimum terms of five years.

These schemes enable investors to invest in mortgages or loans over properties. These investments have minimum terms of five years.

South Africa only has only two participatory bond providers.

![]() These schemes invest in shares, bonds and listed property and other listed and unlisted investments – known collectively as securities. The fund manager chooses securities in line with the fund’s mandate, which sets out the universe of securities from which the fund will invest and also its investment goals.

These schemes invest in shares, bonds and listed property and other listed and unlisted investments – known collectively as securities. The fund manager chooses securities in line with the fund’s mandate, which sets out the universe of securities from which the fund will invest and also its investment goals.

Unit trust funds are the most popular collective investment schemes in South Africa.

There are many different kinds of funds - some invest in any share listed on a stock market like the JSE, while others invest in a sector of the market such as financial shares (the shares of the banks, life companies and insurers). Others invest across share, bond and money markets.

They may also be index funds that track an index such as the FTSE/JSE All Share Index (ALSI).

The price of the units (known as the participatory interests) is calculated once a day and the holdings of the fund are typically published once a quarter.

Read more in our section on Unit trusts

| KEY NUMBERS

1 878: The number of unit trusts and exchange traded funds (ETFs) in South Africa (as at December 31, 2024) R3.87 trillion: The amount invested in them (as at December 31, 2024) 91: The number of exchange traded funds (ETFs) in South Africa (as at December 31, 2024) 77: The number of exchange traded notes (ETNs) in South Africa (as at December 31, 2024) R225,4 billion: The amount invested in ETFs, ETNs and actively managed certificates – known collectively as exchange traded products (ETPs) (as at December 31 2024) Further references for these statistics |

Many exchange traded funds (ETFs) – but not all - are also unit trusts.

Like a unit trust fund, an ETF allows investors to pool their money in a fund that invests in shares, bonds, listed property or other securities.

ETFs, however, typically track the performance of a group or “basket” of shares, bonds or other securities. These baskets of securities are those in an index such as the All Share index. Other ETFs track the price of a commodity such as gold or platinum.

ETFs differ from other unit trusts in two key ways:

Most ETFs are registered as collective investment schemes and enjoy the same legal protection as unit trusts, but a few, such as those that invest in commodities like gold and platinum, are not. No exchange traded notes (ETNs) are collective investment schemes.

When you cash in your ETF investment, you are selling shares on the relevant exchange and the time it takes to pay you out will be determined by the exchange’s settlement period. In the case of equity ETF listed on the JSE, the settlement period is three trading days, but it may take longer to get the money out of your trading account.

You can view the underlying securities of an ETF daily.

Read more in our section on Exchange Traded Funds

South Africa is the only country in the world that regulates hedge funds as collective investment schemes. They were officially classified as collective investment schemes from April 1 2015, with new funds having to register from September that year and existing funds from September 2017.

South Africa is the only country in the world that regulates hedge funds as collective investment schemes. They were officially classified as collective investment schemes from April 1 2015, with new funds having to register from September that year and existing funds from September 2017.

South Africa has two kinds of hedge funds: retail hedge funds and qualified investor hedge funds. Different rules apply to the two types of funds but both can engage in borrowing to invest and can short securities – sell shares, bonds or other securities that they do not own.

Retail hedge funds may be priced daily or monthly, and if you want to cash in your investment, you must be paid out in a month.

Qualified investor hedge funds may be priced daily, monthly or quarterly and can take up to three months to pay you out.

Read more in our section on Hedge funds