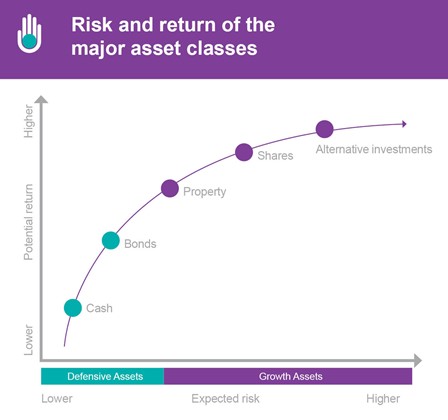

When you think about the range of things in which you can invest on financial markets, it is useful to sort them into their asset classes.

Asset classes are groups of financial instruments or securities that behave in a similar way and the risks you take investing in them are similar.

There have always been four main asset classes. Beyond that other investments are lumped together either in a fifth or sixth asset class and are often referred to as alternative assets.

The asset classes in the six groups are as follows:

Equities

Equities is the asset class for shares that are listed on stock exchanges like the JSE. Read more: How can I make money investing in shares?

![]() Equities are one of the most risky asset classes in which to invest, but these risks can be mitigated by investing for a longer time period and diversifying across a number of different shares. Read more: Why should I diversify my investments?

Equities are one of the most risky asset classes in which to invest, but these risks can be mitigated by investing for a longer time period and diversifying across a number of different shares. Read more: Why should I diversify my investments?

If you are prepared to invest for a longer time period – at least five years – you are likely to earn the highest returns and returns that beat inflation. Read more: What do I know about investment risk and time and Why must my investment beat inflation? and How can I get access to the markets?

Bonds

Bonds

Bonds are loans investors make to governments, parastatals or companies. Typically, these entities parcel the amount they want to borrow into smaller loans that are the face value of a bond, for example, a R1 million. Investors willing to lend by buying a bond are offered a set interest rate for a particular period (until maturity), for example 10% for 10 years. This is why bonds are referred to as fixed interest instruments.

![]() Buying and holding a bond to maturity is known as investing in the primary market.

Buying and holding a bond to maturity is known as investing in the primary market.

If you invest in a bond and hold to maturity, your only risk is the risk that the entity defaults on its promise to repay the loan. Government defaults are rare, but the risk may be higher with certain parastatals and companies.

Before a bond matures, investors can sell them to other investors in what is known as the secondary market. In the secondary market, bond prices are set by investors anticipating moves in interest rates and how these compare to the bond’s interest rate and its term to maturity.

In this secondary market, you can make money if the price of your bond goes higher than what you paid for it or lose if the price goes down. Read more: What is a bond and how can I invest in bonds?

Cash

Cash is the term for an asset class that comprises money in a bank account and some investment instruments that can be quickly converted into cash, earn interest and are very low risk. Some examples are treasury bills, negotiable certificates of deposit, call deposits, notice deposits, banker's acceptances and promissory notes.

![]() Cash investments have one of the lowest risks when it comes to losing your money in the market.

Cash investments have one of the lowest risks when it comes to losing your money in the market.

But if you invest in cash over the long-term at interest rates that are lower than inflation, you can lose money in real (after inflation) terms. This means that although the money you invest will grow with interest, it will buy you less than it did when you invested because inflation has made things cost more and your investment has not kept up.

Listed Property

When you invest in listed property you invest in companies that buy properties – typically commercial ones such as those in the retail (shopping centres), industrial (factories) and office ![]() sectors, but also hotels, apartment blocks, student accommodation, warehouses and cell phone towers.

sectors, but also hotels, apartment blocks, student accommodation, warehouses and cell phone towers.

You can make money if the listed property price goes up in the same way that share prices go up. You can also make money from the rental income the properties earn and the growth in that rental income.

This makes listed property a bit of hybrid of equities and bonds, offering both capital growth and a stable, growing income. Read more: How to make money investing in listed property | Smart About Money

Commodities

![]() Commodity investments include those in oil, metals like gold, silver, copper, platinum and rhodium, as well as agricultural products such as maize or wheat. Financial instruments that give you exposure to commodities include derivatives and exchange traded notes.

Commodity investments include those in oil, metals like gold, silver, copper, platinum and rhodium, as well as agricultural products such as maize or wheat. Financial instruments that give you exposure to commodities include derivatives and exchange traded notes.

Alternative investments

Investment options have broadened beyond the four traditional asset classes to include what are often referred to as alternatives. These alternatives are often investments into either shares or bonds that are not listed on a stock market – private equity, private debt or infrastructure projects. Investments into foreign currencies and hedge funds are also often referred to as alternatives. Hedge funds use different investment strategies and typically derivatives to invest in the traditional asset classes.

Alternative investments, representing alternative ways of investing in traditional asset classes, include private equity, private debt, hedge funds, foreign currencies, infrastructure and unlisted real estate. Read more: What is a hedge fund?

Crypto assets, including cryptocurrencies, remain partially unregulated, and as a result have not yet been included in the categorisation of asset classes.

|

DO YOU KNOW THE DIFFERENCE BETWEEN FINANCIAL AND REAL ASSETS?

|