Unit trust companies are obliged to disclose certain information to you in plain language before you invest or switch unit trust funds.

This information is typically on the fund's fact sheet, which may also be the fund's minimum disclosure document.

The Financial Sector Conduct Authority has listed certain minimum disclosures that unit trust companies have to make in this document.

Here's what you, as an investor or potential investor, should look out for on these documents:

- The name of the fund manager and a statement that it is registered in terms of the Act.

If management of the investments is outsourced to a fund manager, your unit trust management company is also obliged to give you the details of the manager and to state whether it is authorised under the Financial Advisory and Intermediary Services Act to manage your money.

|

- The investment objectives of the fund and a summary of the investment policy must be disclosed - you will typically find this under the heading "Fund objective" and there may also be information on the kind of investor for whom the fund is intended. For example, you may be a long term investor looking for the best growth in your savings over a longer period or you may be someone who is looking to earn the best income from an investment over a shorter period.

|

|

|

- The essential characteristics of the portfolio to enable you to make an informed choice about whether to invest.

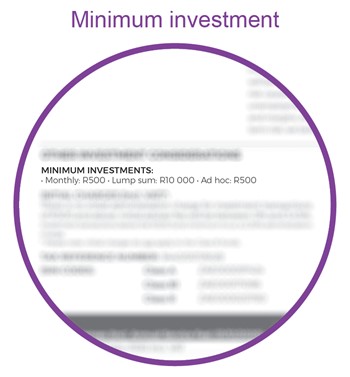

Among these essential characteristics, you should expect to find information about the minimum amounts you need to invest in the fund

|

|

The essential characteristics should include whether the fund is multi-asset one, and if so, if it is one that complies with regulation 28 of the Pension Funds Act, making it a suitable choice for your retirement annuity fund.

|

|

|

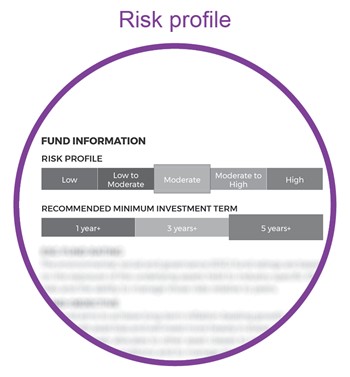

- The fund’s risk profile giving guidance and warnings about how risky the investment is when it comes to the fund losing value. The risk profile of one fund is not necessarily comparable to that of another fund.

|

|

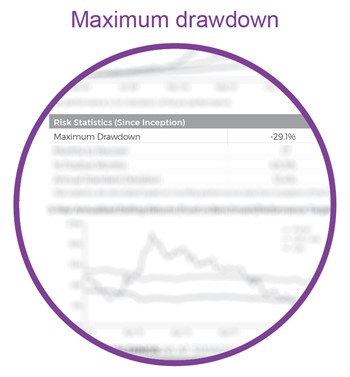

In explaining the risk profile, fund fact sheets often quote the maximum drawdown. This shows you the biggest loss or fall in value the fund has had in its history.

|

|

- The unit trust fund category in which the fund is classified in the Association of Savings and Investment South Africa fund classification system. This tells you what can be included in your fund both in terms of countries or regions and asset classes such as shares, bonds, listed property and cash.

- The most recent performance of the fund over various periods. The performance over one-year, three years and since inception or over 10-years must be published if the fund has the appropriate track records.

Typically, performance over more periods are also shown.

If performance is shown as a cumulative return – that is it shows the total return over multiple years – you should also be told what this amounts to as an average annual return – the return, on average, for each year during a period.

Returns must be calculated using the most expensive fee class available to you, as an individual investor.

- The fund’s benchmark.

|

|

- The fees – initial, ongoing management and performance fees – must be detailed for the most expensive fee class and the total expense ratio and total investment charge must be shown. Advisory fees and any other charges that can be added must also be detailed.

|

- The date on which the fund was launched.

- The dates on which income, interest and dividends are paid out and how much has been paid out over the past 12 months.

- How often the net asset value is published and where you can find it.

- The time each day that the portfolio is valued and time by which you need to give an instruction for a transaction each day. Read more about How is your unit trust fund priced?

- The size of portfolio and the number of participatory units.

- The allocation between asset classes or regions, or, in the case of funds that invest across a market like the JSE, the allocation to different market sectors

- The name of the trustee or custodian.

- The fact that the manager does not provide any guarantee on the performance of your investment and that it can go down as well as up.

- In addition, if the fund is an exchange traded fund (ETF), the minimum disclosure document, should tell you:

- That ETFs are listed on stock exchanges and may therefore incur additional costs.

- The difference between ETFs and other collective investment schemes.

- The index that the ETF tracks and how it tracks it.

- Where you can view the index and its performance as tracked by the ETF.

- The extent to which the ETF is involved in securities (scrip) lending to earn additional income.

- If the fund is a money market fund, the minimum disclosure document or fund fact sheet should point out to you that:

- A money market portfolio is not a bank deposit account.

- Whether the money market fund targets a constant unit value, as is the case with most money market funds, in which one unit equals R1, and a change in the value of the underlying securities results in a change in the fund’s yield rather than its unit value.

- The fact that while most changes in the value of the underlying securities will result in a change in the yield, abnormal losses could result in capital losses.

- How yields are calculated and that excessive withdrawals could result in liquidity issues, which could result in managers delaying pay outs.

- If the fund is an offshore fund in which you invest in a foreign currency, you must be told about any material risks including:

- Potential liquidity constraints that may hamper the repatriation of your funds.

- Macro-economic risks.

- Political risks.

- Foreign exchange risks.

- Tax risks.

- The risk of delays in getting settlements for securities that have been sold.

- Potential limitations on the availability of market information.

Read more about What do you need to know about investing offshore?

The information on the minimum disclosure document must be updated at least once every quarter.

If you request it before you invest, your unit trust management company must also give you details about the holdings in the portfolio to the end of the most recent quarter so you can make an informed decision.

Once you have invested, your unit trust management company needs to tell you quarterly:

- How the fund performed relative to its stated objectives.

- What changes were made to the portfolio.

- The number of units you hold.

- The units’ net asset value.

- The total expense ratio.