Laura du Preez | 08 December 2021

Laura du Preez has been writing about personal finance topics for more than 20 years, including eight years as personal finance editor for two leading media houses.

South Africans continue to invest large amounts of money in unit trusts exposed to foreign markets - on the back of strong performance from these markets over the past decade, rand depreciation and a gloomy outlook for the local economy.

South Africans continue to invest large amounts of money in unit trusts exposed to foreign markets - on the back of strong performance from these markets over the past decade, rand depreciation and a gloomy outlook for the local economy.

This is according to the latest statistics released by the Association for Savings and Investment South Africa (ASISA) that show some R35 billion invested over the year to the end of September in rand-denominated global portfolios, including R5.8 billion over the most recent quarter, according to Sunette Mulder, senior policy adviser for ASISA.

Rand-denominated global equity portfolios which must invest at least 80% of their funds in share markets outside of South Africa have, on average, delivered double-digits annual returns over the past one, five and 10-year periods, Mulder says.

Local equity funds, by comparison, have delivered lower returns on average over the past five and 10 years.

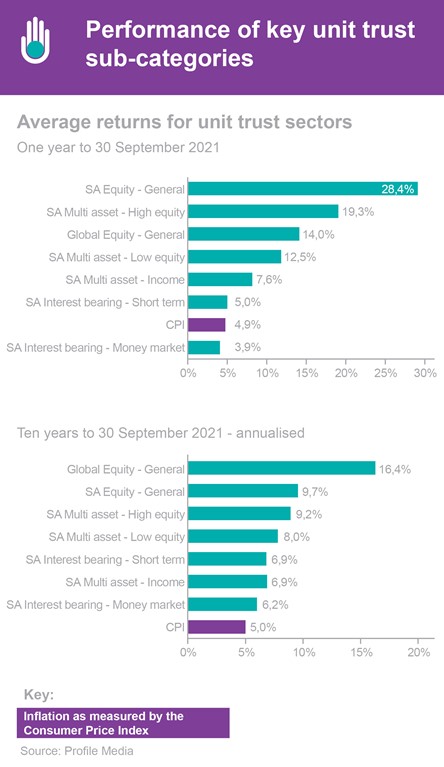

The average annual returns for the key unit trust sub-categories over the past 10 years are shown in the graph alongside.

However, over the past year, local equity funds delivered on average double (28%) what global equity funds returned (14%), the graph of the one-year returns shows.

This demonstrates the benefit of being diversified across both global and local markets.

|

Investment tip To see where different funds invest, try our Fund Classification tool |

Offshore diversification is good

It is good to have exposure to global markets rather than only be invested locally, as it gives you greater diversification and potentially increases returns by exposing you to different factors that drive returns, Nimisha Bhawan, the head of investment advisory at Alexander Forbes, told a recent webinar on global investing.

Bhawan says South Africa’s equity market is among the most concentrated in the world, which is why diversification is important. Read more: Why should I diversify my investments?

Bhawan says South Africa’s equity market is among the most concentrated in the world, which is why diversification is important. Read more: Why should I diversify my investments?

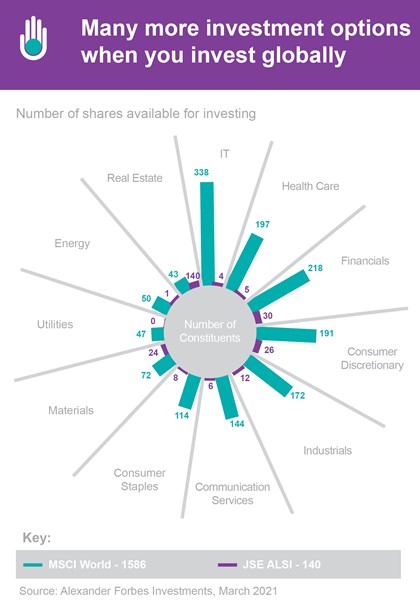

Pieter Koekemoer, head of retail investing at Coronation, says South African investors who restrict their universe to domestic assets not only miss out on opportunities in industries that are hardly present in the local market, such as information technology, biotechnology, electronics, pharmaceuticals, but also on a much wider opportunity set within those industries.

By opening up your investment universe, you gain access to a more diverse opportunity set, as well as to better businesses with better earnings prospects, he says.

Furthermore, international assets give you access to growth regions that benefit from mega-drivers, such as innovation, industrialisation, urbanisation, digital advances and growing consumerism, he says.

Bhawan says the global market index, the MSCI World, which is often the universe for global funds, has many more shares than the All Share index, with many more options in each sector of the market (see graph alongside).

Tempting to up global exposure

Koekemoer says it is tempting to increase your exposure to foreign markets when sentiment about South Africa is negative or the rand is weakening.

However, having exposure to foreign asset classes is not about the timing, but rather your allocation should be made for strategic reasons in line with your long-term investment plans.

Selling out of local markets and buying into global markets when sentiment is negative and the rand is weak can result in you selling when these investments are cheap and buying into global markets when it is expensive to do so, he explains.

Long-term investors should ideally buy into a market when it is cheap and sell when it is expensive.

How much to allocate global

When you consider how much to invest in global markets, remember that the amount you can invest may be subject to the Reserve Bank’s exchange controls, or prudential regulations that apply to retirement funds, she says.

Retirement funds are limited to 30% in global markets with a further 10% in Africa.

If you are not investing in a retirement fund or any other product with investment restrictions, you can invest in rands into global funds. There are no restrictions, but some funds may at times close to new investments as the asset manager reaches the maximum asset swop allowance in terms of exchange controls – the amount of rands the manager can swop into other currencies.

If you are using your offshore exchange control investment allowance to invest directly into foreign markets, your allowance (up to R11 million a year) is your only restriction. Infographic: How you can invest offshore with unit trusts

Global exposure sweet spot

Bhawan says although there is no single ideal offshore allocation for everyone, Alexander Forbes has found that the sweet spot for offshore exposure is around 30% of your investments. Beyond this the additional return you earn relative to the risk you take diminishes with every additional percentage invested offshore, she says.

Coronation’s research also shows that at around a 30% allocation to offshore markets, you optimise the returns you earn relative to the investment risk taken.

Bhawan says your decision on how much to invest in global markets should be in line with your appetite for investment risk.

Koekemoer says investors who can justify allocating more than 30% to international markets are those who:

Having a higher exposure to offshore markets may also be warranted for those planning future spending in a foreign currency. This would include spending on overseas travel or business opportunities, investing for an overseas education or emigration.

As you approach retirement, your allocation to foreign markets in your retirement savings should be aligned with the decisions you make on how to provide an income in retirement, Bhawan says.

This in turn depends on the income you need, how much you will draw from your retirement savings and whether you want to leave a legacy for your heirs, she says.

Consider this when you go global

The simplest way to get access to global markets is to use a local manager’s global fund as you can invest in rands and be paid in rands and you can easily contact the local manager.

Bhawan says local managers’ global options tend to be expensive as managers need a lot of resources to research an exponentially bigger universe of assets for what is often only a small portion of the total amount the manager manages.

Some larger managers have international offices and boots on the ground but this tends to push up fees, she says.

If you use a feeder fund that accepts rands and invests into a single offshore fund, beware of paying more than one layer of fees, she says.

Investing directly offshore, however, may be less convenient and may cost you as you have to convert rands into a foreign currency before investing.

The fees charged on funds based in other countries are typically based on the foreign currency amount you invest and charged on a sliding scale - getting cheaper as you invest more. The fee bands for the sliding scale being in, for example, US dollars, results in most south African investors falling into the band with the highest fees, Bhawan says.

You also need to take more care when choosing a fund as, for example, the fund structure and regulation may differ from that in South Africa. A safer option for South Africans is to invest in offshore funds that have been approved by the Financial Sector Conduct Authority. Read more: How can I invest safely offshore?

|

Did you know? The fortunes of many companies listed on the JSE are linked to global markets and global growth, Nimisha Bhawan from Alexander Forbes says.

Bear this in mind when you consider how much global investment market exposure you need, Bhawan says. |

She says 65% of the earnings (profits) made by companies represented in the All Share Index come from offshore sources and 56% of earnings of companies in the

She says 65% of the earnings (profits) made by companies represented in the All Share Index come from offshore sources and 56% of earnings of companies in the