Laura du Preez | 11 July 2023

Laura du Preez has been writing about personal finance topics for more than 20 years, including eight years as personal finance editor for two leading media houses.

Savings month is a good time to learn about saving and long-term investing. Investing can seem a very confusing topic and a practice reserved only for those who know a lot.

![]() But actually, some basic know-how can get you saving and investing – possibly even better than those who are overconfident and take on too much risk.

But actually, some basic know-how can get you saving and investing – possibly even better than those who are overconfident and take on too much risk.

When you start saving and investing, it is useful to consider what financial markets have delivered to South African investors over a long period of time and what can happen over shorter periods. Then make your decisions in line with your goals or what you want to achieve.

1. Savings typically earn just above inflation

We all need savings, but savings in a bank savings account, fixed deposit, money market account or even a retail savings account typically earn only a small return above inflation. Investments held for longer terms, however, can earn more than inflation. Read more: What is the difference between saving and investing?

![]() Interest rates are currently high – as the 2023 savings month started, money market funds were offering yields between 8.3% and 8.6%. But inflation is also currently high at 6.3%. This means your after-inflation or real return is only around 2% -2.3% a year.

Interest rates are currently high – as the 2023 savings month started, money market funds were offering yields between 8.3% and 8.6%. But inflation is also currently high at 6.3%. This means your after-inflation or real return is only around 2% -2.3% a year.

Old Mutual has been tracking the returns from different asset classes over a very long period – about 93 years. Its latest research in the 2023 Long Term Perspectives shows that over the past 20 years cash investments, like money market funds, have on average returned just 1.8% a year above inflation (the real return).

But over the longer 93 years – the average real return is 0.9% a year. And over the past five years it has been 0.8% a year. At that return it will take you 88 years for the money you deposit in a savings account to double.

2. To grow wealth you need to invest in equities

|

RETURNS FROM THE ASSET CLASSES |

||

| Saving/investment |

Average return for past 93 years |

Average real (after-inflation) return for 93 years |

| Cash only (bank savings or money market fund) | 6.8% | 0.9% |

| SA Equities (shares in an index) | 13.6% | 7.2% |

| Global Equities (in rands) | 13.7% | 7.3% |

| Multi-asset fund | 12% | 5.7% |

| Source: Old Mutual Long Term Perspectives 2023 | ||

If you want the money you save to do more than just keep up with inflation, you need to earn a return that is well above inflation. To earn those returns you need to invest at least some of your money in shares - also known as equities.

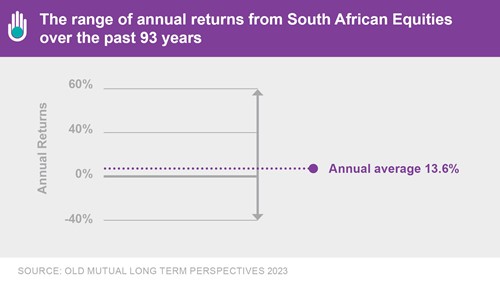

Old Mutual’s Long Term Perspectives shows that the return on South African equities over the past 93 years has been 13.6% a year - which is a return of 7.2% above inflation.

With this kind of return, you can double the money you invest today in 10 years, instead of 88, Old Mutual says.

3. Equity returns are volatile

The problem with equity returns is they do not deliver the average 13.6% year after year. Instead, they can return anything from minus 40% to plus 60% in any year.

The problem with equity returns is they do not deliver the average 13.6% year after year. Instead, they can return anything from minus 40% to plus 60% in any year.

![]() If you invest in equities, you have to be prepared for the ups and downs in your returns. This volatility is the investment risk you take in order to earn the higher returns.

If you invest in equities, you have to be prepared for the ups and downs in your returns. This volatility is the investment risk you take in order to earn the higher returns.

There are, however, two ways to manage this risk:

a. Invest for longer

|

|

|

| Investment term | Probability |

| One year | 20% |

| Three years | 6% |

| Five years or longer | 0% |

| Old Mutual Long Term Perspectives 2023 | |

Old Mutual’s research shows that while you have a 20% chance (one in five) of earning a negative return from equities in any one year, after three years, your average return over that period has only a 6% chance of being negative. After five years, the likelihood of a negative return is negligible. Read more: What do I need to know about investment risk and time?

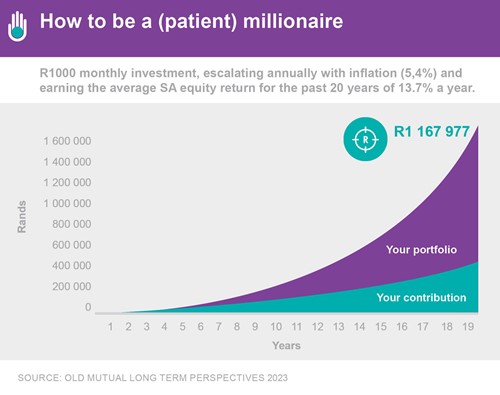

A benefit of investing for longer is that you harness the power of compounding. If you save R1000 a month for 17 years you will  have contributed around R200 000 to your investment. But your investment could be worth R1 million if you earn the average equity return of 13.7% a year and you reinvest the returns – the other R800 000 will come from compounding. Read more: Why compounding growth is so important?

have contributed around R200 000 to your investment. But your investment could be worth R1 million if you earn the average equity return of 13.7% a year and you reinvest the returns – the other R800 000 will come from compounding. Read more: Why compounding growth is so important?

b. Diversifying across assets

You can also diversify your investment, investing less than 100% in shares and adding in some bonds, listed property and cash. Adding these asset classes both locally and globally increases that diversification. Read more: How do asset classes classify the things in which you can invest? and Why should I diversify my investments?

Old Mutual’s research considers a hypothetical unit trust invested across asset classes, a multi-asset fund with just 70% in equities and the rest in the other major assets classes, delivering returns in line with the markets for each asset class. This fund has delivered an average return of 12% a year since 1930, which is 5.7% above the average inflation rate since then.

![]() There are five kinds of multi-asset funds, each investing up to a different level into equities. The ones that should deliver a return in line with the long-term average of 12% that Old Mutual has calculated are those that can invest up to 75% in equities.

There are five kinds of multi-asset funds, each investing up to a different level into equities. The ones that should deliver a return in line with the long-term average of 12% that Old Mutual has calculated are those that can invest up to 75% in equities.

These funds are typically recommended for investments when you have more than a five-year investment horizon. Read more: Why are there different kinds of multi-asset funds?

c. Diversify across local and offshore equities

If you are worried about exposure to the South African market because the local economy is suffering, remember that the market is not a mirror of the economy.

Many South African companies earn a substantial portion of their profits from offshore activities and their shares are known as rand-hedge shares.

Many South African companies earn a substantial portion of their profits from offshore activities and their shares are known as rand-hedge shares.

At the recent Meet the Managers conference Andrew Vintcent, director and portfolio manager at Clucas Gray Asset Management, said the Capped Shareholder Weighted All Share index that many local managers use as a benchmark has a 34% exposure to rand-hedge shares and 25% of the index is made up of mining and resources shares whose earnings come from exporting commodities.

In addition, all South African funds, including multi-asset funds, can now invest up to 45% of the fund in offshore markets and many managers consider between 35% and 38% as the optimal offshore exposure.

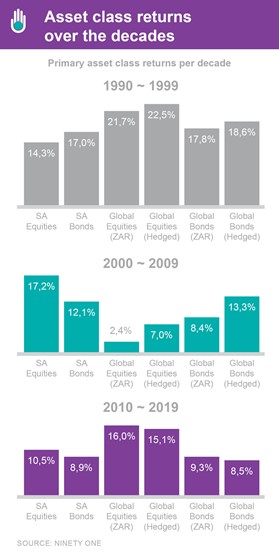

The portfolio manager for South African equity and multi-asset at Ninety One, Rehana Kahn, told the manager’s recent global investment summit that based on an analysis of returns over the past 100 years, 38% was the optimal offshore exposure.

However, she said that returns have varied across the decades and it is therefore best for managers to actively change that optimal allocation in line with the expected returns from the different asset classes.

The optimal allocation in the decade 2000 to 2009 would have been 59% to local equities and nothing in global equities, whereas in the decade 2010 to 2019, the optimal allocation to local equities should have reduced to 8% and global equities increased to 35%.

Vintcent estimated the average offshore exposure of South African multi-asset funds is currently 38.7% and this combined with the offshore earnings of many large South African shares means funds have materially less exposure to South Africa than ever before.

Use investments that suit your goals

If you are younger and saving for a goal less than three years away, your investments should be ![]() skewed towards safer cash-like investments.

skewed towards safer cash-like investments.

If your investment horizon is longer, your tilt towards equities should increase, making up the majority of your investments when your investment horizon is ten years or more away. Read more: How do I set savings and investment goals?

This is when your money can work the hardest for you because the returns are potentially the highest and they in turn earn more returns through compounding.

What is the difference between saving and investing?

What do I need to know about investment risk and time?

Why compounding growth is so important?

How do asset classes classify the things in which you can invest?

Why should I diversify my investments?

Why are there different kinds of multi-asset funds?

How do I set savings and investment goals?

The new global investment reality

Fund classification tool