Abdallah Moosa | 20 July 2022

Abdallah Moosa is an actuary and a planner at Fiscal Private Client Services. He has worked in financial services since 2012 and has a passion for investments and the world of finance.

The worst investment decision you can make is not investing at all.

Many people – even the well-educated - end up in this position, and it is probably due to “choice overload”. With the internet at our fingertips, we can easily search for different ways to invest or different investment options.

Many people – even the well-educated - end up in this position, and it is probably due to “choice overload”. With the internet at our fingertips, we can easily search for different ways to invest or different investment options.

On top of that, social media influencers are promoting buzzwords like “NFT”, “Crypto”, coin-this, coin-that – we have a plethora of things to consider which ultimately leads to an information overload.

It then feels much easier to defer our decision to later and leave unspent money in our bank accounts to collect a measly bank savings return.

The danger with this is that soon years go by, and the rising cost of goods and services erodes our purchasing power. Not to mention missing out on the power of compounding returns. Read more: Why compounding growth is so important.

The opportunity cost of doing nothing

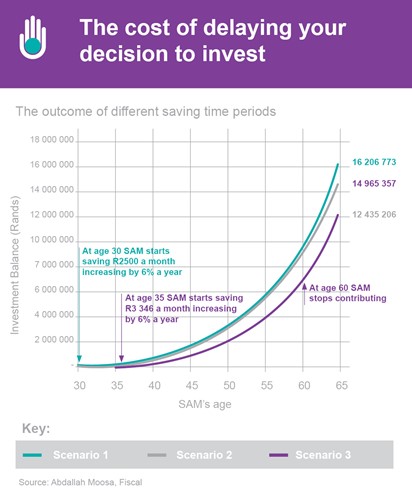

To illustrate the opportunity cost of doing nothing for prolonged periods, let’s consider three scenarios for the same investor. Let’s assume it is Sam, a self-employed freelance photographer aged 30.

Scenario 1

Assume Sam starts saving towards retirement by investing R2 500 a month via debit order into a retirement annuity with unit trust investments. Every year, this contribution automatically increases by 6% to keep up with expected long-term inflation.

Scenario 2

Assume Sam only starts retirement saving five years later, at the age of 35. To keep up with inflation, Sam’s starting monthly contribution at this point is R3 346 a month.

Since the time period for which Sam contributes in scenario two is five years shorter than in scenario one, we would expect scenario one to lead to a better outcome. However, while the difference in contributions is not that big, the final amount accumulated in scenario one is significantly higher as illustrated by the table below:

| Scenario 1 vs 2 | ||||

| Scenario 1 | Scenario 2 | Difference | Change (%) | |

| Time in the market | 35 years | 30 years | 5 years | |

| Number of contributions | 420 | 360 | 80 | |

| Total contributed | R3.36m | R3.19m | R170 000 | 5% more |

| Projected closing balance | R16.20m | R12.44m | R3.76m | 30% more |

Spot the huge differences

Sam contributes for a longer period – 35 years - in scenario one, contributing a total of R170 000 more than in scenario two.

However, the extra five years spent in the market gives Sam R3.76 million more at the end of the period. This means that for 5% more in contributions and five years extra in the market, Sam gets a 30% higher closing balance, assuming all other factors are the same.

What catching up would cost?

If we calculate the starting monthly contribution Sam would need to make under scenario two to end up in the ![]() same position as scenario one, it would be R4 360 a month.

same position as scenario one, it would be R4 360 a month.

This would mean Sam would need to contribute a total of R4.16 million over 30 years to get the closing balance of R16.2 million achieved in scenario one. This is 24% more than what Sam needs to contribute when starting to save five years earlier as in scenario one.

Scenario Three

If Sam had started saving at the age of 30, as in scenario one, but then stops contributing five years before retirement, the outcome would still be better than scenario two.

In both scenario two and three, Sam would be contributing for 30 years (making 360 contributions), but under scenario three Sam starts five years earlier which results in 35 years in the market.

Under scenario three, Sam still ends up with 20% more than under scenario two, despite having made the same number of contributions.

| Scenario 3 vs 2 | |||||

| Scenario 1 | Scenario 2 | Scenario 3 | Difference | Change (0%) | |

|

Time in the market |

35 years | 30 years | 35 years | 5 years | |

| Number of contributions | 420 | 360 | 360 (Stops making contributions 5 years before retirement) | - | - |

| Total contributed | R3.36m | R3.19m | R2.38m | R810 000 | 25% less |

Time in the market

The key takeaway here is that time in the market is most important, which means starting as soon as possible is the best strategy.

This may mean finding a balance between meeting your monthly expenses, servicing debt, and saving.

However, any contribution you can make from an early age will make a significant difference to what you will have available at retirement. This will ultimately determine the lifestyle you can afford.